Life Insurance in and around Gilbert

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

When facing the loss of your spouse or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and try to move forward without your loved one.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

Having the right life insurance coverage can help loss be a bit less debilitating for your loved ones and give time to recover. It can also help meet important needs like childcare costs, home repair costs and retirement contributions.

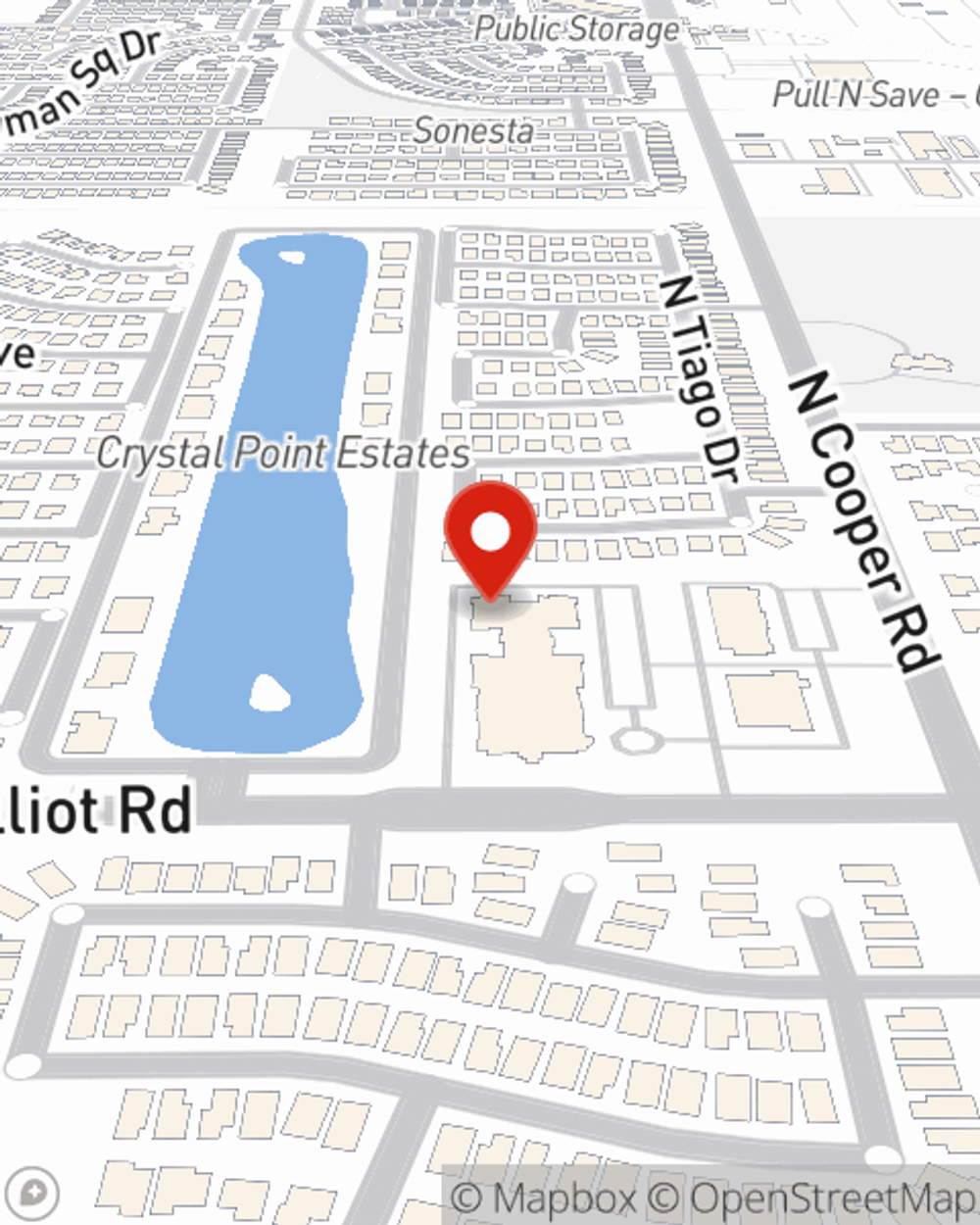

If you're looking for reliable coverage and considerate service, you're in the right place. Contact State Farm agent Chris Bernard now to get started on which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Chris at (480) 812-2886 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Chris Bernard

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.